Predictive Modeling: The Future of Your Business

In order to give human users a clearer image of the world around them and even a glimpse into the future, complex systems connect to and analyze different databases.

Unfortunately, many businesses still employ antiquated analytics that provides them with static, historical reports that only summarise the past and are useless for making future plans. No one can predict the future with total confidence, but even having a general notion of what to expect in the upcoming quarter or year can help businesses develop and industries change.

These kinds of predictions, as well as predictive analytics itself, are based on a thorough comprehension of the past and present as portrayed in the data.

You can check the data science course online to learn more ways to grow your business. To survive in this competitive environment, let us learn about predictive modeling.

What Is the Definition of Predictive Modelling?

In order to analyze historical data and identify patterns and relationships between data points, predictive modeling makes use of mathematical and computational techniques like probability and data mining.

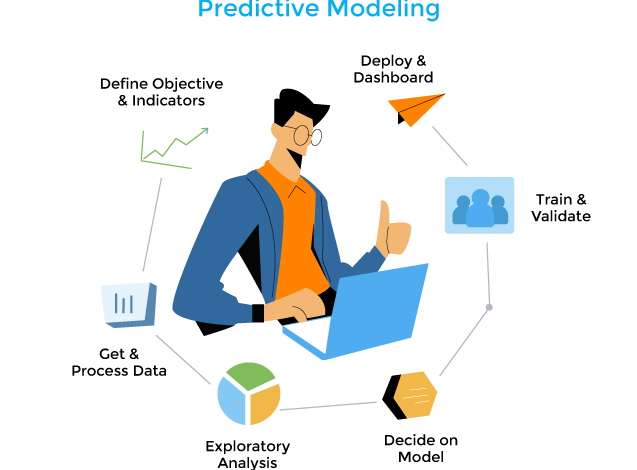

The first step in predictive analytics is data collecting, and next comes the creation of a statistical model after these two processes come the data analysis and forecasting process.

To provide accurate results, data analysts must make adjustments to the predictive model for each new data set.

Applications of Predictive Modeling

Predictors of well-known traits are used in predictive analytics to build models and produce results. Predictive modeling can be applied in hundreds, if not thousands, of different ways. Investors, for instance, use it to spot trends in the stock market or specific equities that could signal potential investment opportunities or turning points.

An investment’s moving average, which smooths price swings to assist in identifying trends over a certain period, is one of the most popular models investors use. Additionally, the future values of an investment or index are predicted using autoregression.

Identifying potential outcomes for various situations is another way that predictive modeling aids investors in managing risk. Data manipulation, for instance, can be used to predict what would occur if a key event changes. By recognizing potential outcomes, investors can develop strategies to deal with shifting market conditions.

Types of Predictive Modeling

Supervised and unsupervised models are the two basic categories all predictive models fall into. Unsupervised models then classify the data using conventional statistical techniques. Some examples of unsupervised models are time-series analysis and logic regression.

Supervised models, on the other hand, use cutting-edge machine learning methods to find a pattern and cluster it. So, some examples of supervised models include neural networks and clustering models.

Here are the main types of predictive modeling.

Classification Model

The simplest prediction model is the categorization model, and it divides data points into many groups for straightforward answers.

The four most common classification model types are as follows:

- A binary is: used to detect spam

- Multiple classes: used to find patterns

- Multiple labels are used to examine various items.

- Unbalance: Used in healthcare (medical diagnosis) and fraud detection.

Clustering Model

By grouping together comparable pieces of data, the clustering approach makes it easier to manage large amounts of data. Clustering methods are used in computer graphics, machine learning, data compression, image analysis, and pattern identification.

Forecast Model

One of the most well-liked predictive models is the forecast model, and it now functions on anything with a numerical value. The approach is also employed for measuring data processing speed, studying enormous data sets, finding hidden data sequences, and other tasks.

Outliers Model

The anomalous data items are analyzed by the outliers predictive model. Consequently, businesses employ this paradigm to analyze discrete data. To identify fraud, this prediction model is primarily employed in finance. They assist in identifying unusual data sets and forecasting information about certain data types.

Time Series Model

Businesses utilize the time series model to base their scientific predictions on time-stamped data. Interest rates, temperature data, stock prices, and other variables are some of the best examples of this kind of predictive modeling.

Advantages of Predictive Modelling in Business Analytics

Predictive models can be used in business analytics since they offer many benefits. Here are a few advantages that any business analyst can gain from developing and using predictive models.

Identifying Business Fraud

To identify both internal and external business fraud, predictive modeling is essential. In order to map out the potential for illegal behavior, model algorithms search for anomalies and inconsistent behavior. With the expansion of cybersecurity difficulties, predictive models attack any seeping flaws to build a trustworthy system. Moreover, staying updated with the latest techniques and tools is crucial in this rapidly evolving field. Enrolling in a comprehensive data science course can provide professionals with the necessary knowledge and skills to effectively leverage predictive modeling in combating fraud and enhancing cybersecurity measures.

Effective Marketing Campaigns

Predictive modeling can be used to carry out effective marketing campaigns since it makes use of metrics and statistics relating to consumer behavior and bases its campaign agenda on them. To further work on modifying their marketing plans and aligning them with client demand, the models examine purchasing trends, preferences, and other information about the customer.

Risk Management

Predictive models’ primary advantage is risk management. For instance, organizations like banks rely on a person’s credit score to approve services and investments, which frequently goes wrong when the system needs to conduct a background check on the applicant. Fortunately, predictive algorithms take care of the problem by assessing previous data to determine the likelihood of fraud or a person’s creditworthiness.

Why Should We Use Predictive Analytics?

Predictive analytics is revolutionizing. Hence, you must learn about these models to incorporate them into your business. Businesses that have a more accurate view of the future are in a far better position than those that rely on their planning on the previous 90 or 12 months. Instead of relying on hazy assumptions based on outmoded information, these organizations can now make judgments supported by a wealth of specific insights.

Predictive analytics operate best when they incorporate intelligence directly into workflows, automatically directing users to take the appropriate action at the appropriate moment to create the future they desire. Predictive analytics can also help executives determine the general direction and course of a company’s decisions.

There is one more thing to say about predictive analytics if they are the holy grail of business intelligence: They exist now, and businesses are making use of them, unlike the grail. Some businesses will gather and combine data while concentrating on the past. Others, though, will move ahead and use that information to look days, months, or even years into the future.

Business Analytics Certification

Adding business analytics skills can easily strengthen your resume and help you grow your business. Under the direction of industry professionals, the program is developed in accordance with the most in-demand competencies in the business analytics sector. It includes topics like Data Visualisation, Exploratory, Data Analytics, Advanced Machine Learning Techniques, and more to keep your skill set current.

The platform extends a well-designed course structure and offers additional advantages like peer-to-peer networking, job advice, mentorship, etc. This will surely bring you exciting opportunities.

Conclusion

A key component of business analytics is predictive modeling, which aids organizations in achieving peak performance. The results generated by these models are more insightful, supported by metrics, and precise than those from any other prediction method, which helps the organization’s present and future performance. To further enhance their analytical capabilities, professionals can consider enrolling in a comprehensive business analytics course.